Cocoa Bean’s Correlation With NVIDIA Hits Over 90 Percent Amid a Cascade of Margin Calls and Exploding Price

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy.

It is not often that one has the opportunity to mention the humble cocoa bean and the AI powerhouse NVIDIA together, that too, in a single sentence. Yet, this unlikely scenario has now become a reality, courtesy of the almost manic propensity of the two disparate assets to scale heretofore unfathomable zeniths.

Related Story Qualcomm, Intel, & Google Join Hands To Come For NVIDIA, Plans On Dethroning CUDA Through oneAPI

Earlier today, the price of the cocoa bean - an essential ingredient in coffee and chocolate - hit an all-time high of $10,000 per metric ton, giving rise to a veritable frenzy in the fintwit sphere.

As we noted in a dedicated post back in February, several factors have coalesced to create a near-perfect storm for cocoa's supply:

- The last major cocoa tree planting spree occurred in the early 2000s in West Africa, which accounts for around 75 percent of the current global supply. Those trees, however, are now around 25 years old and well past their prime.

- Bad weather, accentuated by the ongoing El Nino phase of the Pacific Ocean, has decimated cocoa trees in Ghana and Ivory Coast. The weather has been responsible for a poor cocoa crop for the past three years. However, this year's disruption has been particularly acute.

- The world is heading toward an annual supply deficit of between 300,000 and 500,000 tons, which is the largest such shortfall in over six decades.

The effects of cocoa's physical shortfall are now permeating the financial sector, which is only amplifying these headwinds:

- Cocoa consumers and traders often try to protect their physical stock from price fluctuations by shorting (selling) cocoa futures contracts. This way, one position offsets the losses in the other.

- In a rising price environment, such traders and raw consumers suffer losses on their short futures position and have to continually post

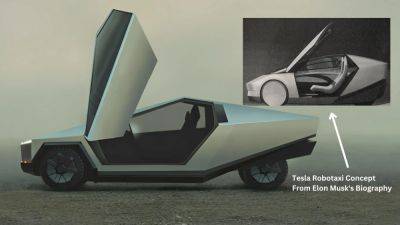

![Tesla Nears 52-Week Lows as It Scraps Plans for a Cheaper EV Amid Fierce Chinese Competition [Update: Elon Musk Says Reuters is Lying]](https://warbulletin.com/storage/thumbs_400/img/2024/4/5/11884_d3ha.jpg)