Billion Dollar Fund Dumps NVIDIA, Buys Arm After Warning About A “Bubble”

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy.

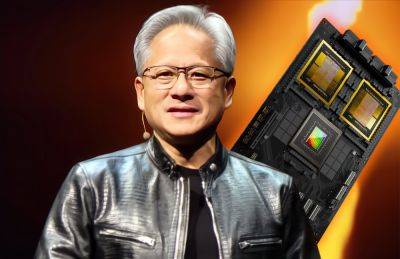

Activist hedge fund Elliot Management has sold its $4.5 million stake in GPU designer NVIDIA Corporation after calling the stock a bubble in an investor letter that surfaced earlier this month. Elliot is one of the more well known names on Wall Street due to its aggressive approach towards buying distressed securities and attempting to profit from them in the case of a turnaround. Its scathing investor letter, first reported by the Financial Times, had taken a bearish approach to artificial intelligence by bemoaning the lack of use cases for the new technology that has propelled NVIDIA's market value to record highs in 2024.

Elliot Management Sells ~$4.5 Million NVIDIA Stake After Sending Scathing Letter To Investors

The fund had taken an aggressive tone against NVIDIA in its investor letter, which included claims from some of AI's biggest detractors. As per the Financial Times, Elliot hadn't held back and stated that not only was NVIDIA a "bubble" but that the firm, along with its mega cap technology peers were all in "bubble land."

Related Story Chinese AI Startups Are Opting For GeForce RTX 4090 GPUs As NVIDIA’s H20 Accelerators Offer Poor Value

Elliot's decision to divest from NVIDIA comes after a rough hedge fund filings season for mega caps. Other notable moves in the second quarter include Bill Ackman's Pershing Square cutting its take in Google parent Alphabet by roughly 20% and Warren Buffett's Berkshire Hathaway slashing its Apple holdings in half.

Elliot Management had owned 50,000 NVIDIA shares during the first quarter, which amounted to a $4.5 million stake for the fund, whose SEC filings had revealed $16 billion in total investments. Now, its latest SEC filings show that it has sold all of its shares and eliminated NVIDIA from its investment portfolio.

However, this doesn't mean that the firm has completely given